A few factors all successful chiropractic coding and billing procedures have in common include smart practice management, healthy accounts receivables, well-trained employees, and the capacity to appropriately code and document diagnosis.

We have put together latest trends to help you in navigating the complex world of chiropractic medical billing. This will assist you in achieving your primary objective, whether it is to improve cash flow, reduce claim denials, or boost your practice. Incorrect chiropractic CPT codes can result in claim rejections and payment delays, putting your practice at danger of failure.

Telehealth Services

Telemedicine proved to be a useful way for clinicians to engage with patients and enhance access to care when the pandemic restricted individuals to their homes. Video/audio communication between a health care professional and a patient is referred to as telehealth (real-time or recorded for evaluation at a later time).

Recognizing the importance of telehealth in these difficult times, the Centers for Medicare and Medicaid Services (CMS) increased the number of covered telehealth services to 135 and made numerous telehealth flexibilities permanent. Many payers are also covering telemedicine chiropractic treatments, albeit it’s critical to understand state, municipal, and payer laws in order to file appropriate claims.

Are you not sure how to go about billing for chiropractic telehealth services? In order to file proper claims, you must first understand your state, local, and payer requirements.

Chiropractors can use telemedicine to communicate with patients in order to:

- Discuss the signs and symptoms.

- Exercises to be prescribed.

- Change any habits that may be exacerbating the pain.

- Give suggestions on self-management techniques that can be implemented at home.

- Evaluate patient progress.

- Follow-up with patients.

- Respond to patient’ inquiries.

Telemedicine CPT codes 99421-99423 can be used for established patients who have not received in-office Evaluation and Management (E/M) services invoiced by the same physician within the previous seven days.

In circumstances where it is medically appropriate for the patient to be assessed and managed over the phone, telephonic E/M services (CPT codes 99441-99443) can be offered. The E/M service was performed via telehealth, as indicated by the modifier 95 attached to the code.

Telehealth billing and reimbursement, like any medical billing, can be complicated. Before the visit, patients’ eligibility must be checked. Billing telemedicine appointments has distinct restrictions for commercial insurance carriers. Providers should inquire about CPT codes which can be used to bill for telehealth services. They should be familiar with each payer’s telehealth policy and double-check with each before filing a claim to verify compliance. The best method to assure correct claim submission and timely payment for telehealth services, is to hire a professional chiropractic billing business.

Medicare Changes

A chiropractor must have evidence to support the treatments in order to be paid by Medicare, as mandated by Federal Law and regulations, as well as CMS guidelines. According to CMS guidelines, chiropractors must enter the date of the first treatment on a claim that serves as the chiropractor’s declaration that all relevant documentation is filed. The amount of approved chiropractic services that a policy-holder can get is not limited by CMS.

The Chiropractic Medicare Coverage Modernization Act will expand Medicare coverage of services provided by chiropractors within the full scope of their state licensure, allowing chiropractic patients to easily and securely utilize additional covered services that may be medically appropriate. In addition, the adjustment would bring Medicare in line with chiropractic coverage provided by many commercial health and Medicare Advantage plans. The opioid crisis has aggravated the need for Medicare beneficiaries to have access to the chiropractic profession’s wide ranging, non- pharmacological approach to treating pain, which includes manual intervention of the spine and extremities, assessment and professional systems, diagnostic imaging, and use of other nondrug treatments and methods.

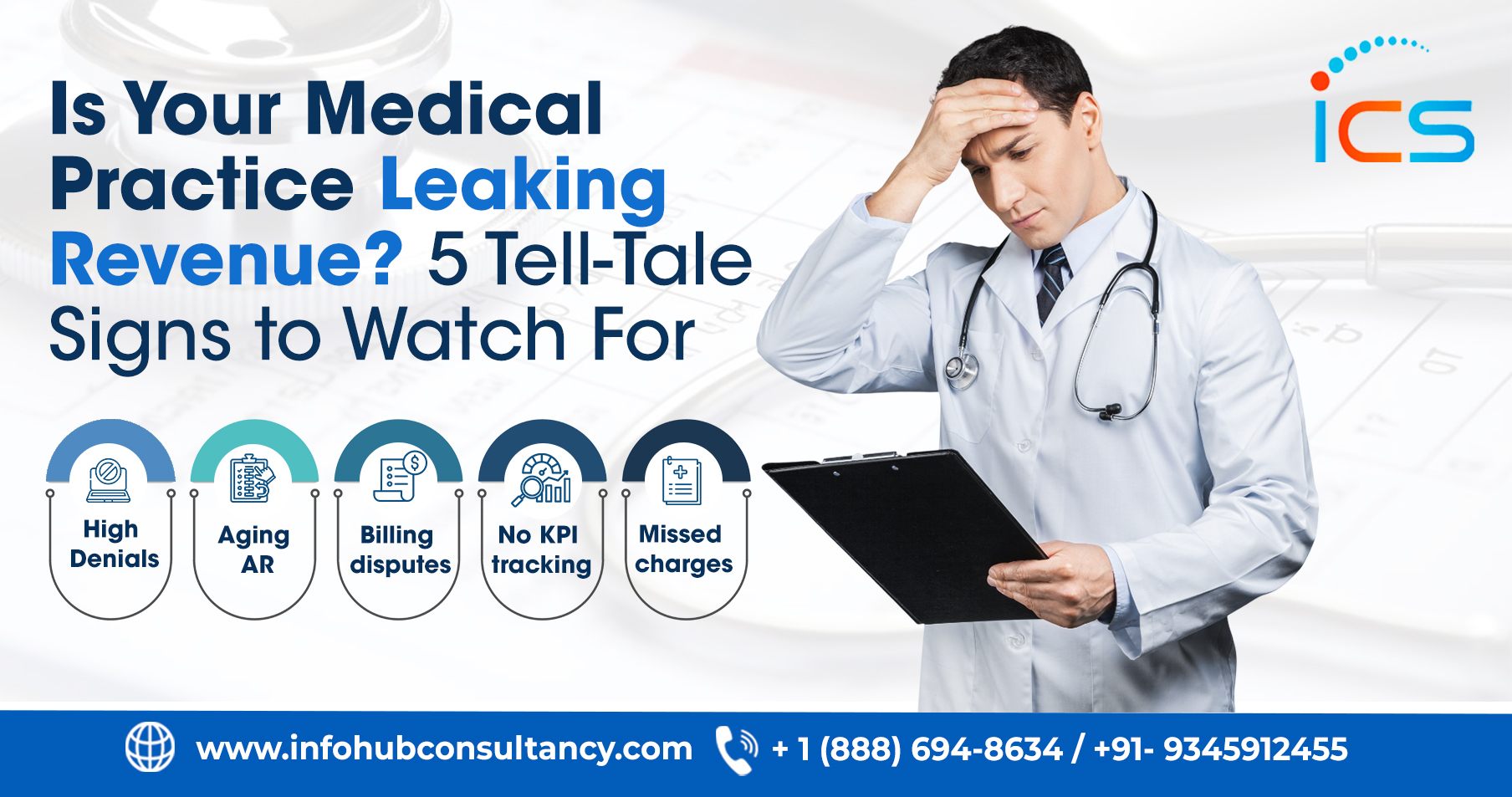

Billing with incorrect chiropractic CPT codes can result in claim rejections and payment delays, which can have a serious impact on your practice’s capability to generate revenue and stay in business. Info Hub Consultancy Services (ICS) is your solution if you’re having problems with insurance claim denials, staff spending too much time trying to get claims paid, and patients asking why their claims haven’t been paid. By utilizing their direct channel of communication with the insurance companies and organizations that set the guidelines, ICS remains ahead of the curve on the newest trends and changes in chiropractic billing and coding.

4 mins read

4 mins read

.png)