Did you know?

Claim denial rates have increased by more than 20% over the past five years, placing a growing strain on cash flow and operational stability.

As payers implement advanced analytics and AI-driven claim review systems, submissions are evaluated more rigorously for compliance, medical necessity, and policy alignment. Also, the expansion of prior authorization requirements and frequent payer policy updates has added layers of complexity. As a result, it has become increasingly difficult for providers to submit clean claims on the first attempt.

Keeping this complexity in mind, this blog explains why claim denials are increasing and outlines practical strategies providers can use to reduce denials and protect their revenue cycle performance.

Reasons for Increasing Claim Denials

Claim denials continue to rise due to a combination of stricter payer oversight, evolving technology, and operational challenges within healthcare organizations. As payers rely more on automated systems and enforce detailed coverage rules, even small gaps in claims can lead to rejection. At the same time, workforce instability and frequent policy changes increase the likelihood of preventable errors across the billing process. The following are the main reasons for increasing claim denials:

-

Advanced Payer Technology and AI Enforcement

Payers now rely heavily on AI-based claim review systems that evaluate submissions instantly. These tools are designed to detect inconsistencies, missing information, or deviations from coverage guidelines. As a result, claims that previously passed manual checks may now be denied automatically. Even minor documentation or formatting issues can trigger immediate rejection.

-

Expanded and Complex Prior Authorization Requirements

Prior authorization has become mandatory for a growing number of services across healthcare settings. When authorizations are missing, incomplete, or mismatched with claim details, denials occur frequently. Additionally, payer-specific rules and frequent updates make it challenging to ensure approvals align perfectly with final submissions, increasing the risk of denial.

-

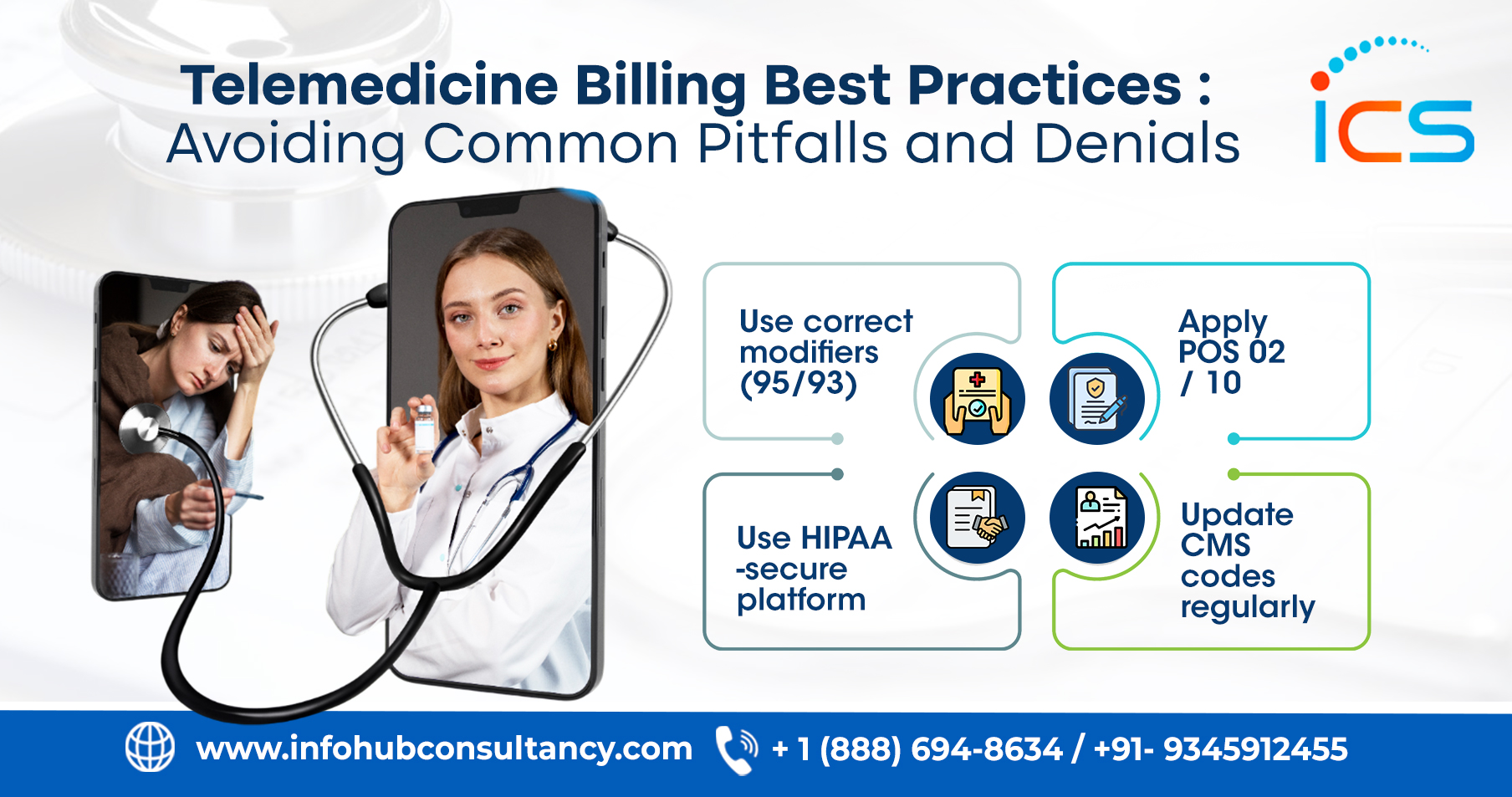

Documentation and Coding Challenges

Clinical documentation must clearly support the services billed, yet many denials stem from unclear or insufficient records. When medical necessity is not well explained, payers are more likely to reject claims. In fact, coding errors also remain common as CPT and ICD-10 guidelines evolve, particularly for telehealth and newly introduced procedures.

-

Front-End Data and Eligibility Issues

Many denials originate before a claim is even created. Incorrect patient demographics, inactive insurance coverage, or coordination-of-benefits errors often go undetected during intake. In fact, payers deny the claim when these issues surface after services are rendered. Therefore, it results in delayed payments and an additional administrative burden.

-

Workforce Turnover and Administrative Strain

Healthcare organizations continue to face staffing shortages and frequent employee turnover. As experienced staff leave, knowledge gaps emerge among newer team members. Without sufficient training or oversight, billing errors increase, submission quality declines, and denial rates rise due to avoidable clerical and compliance mistakes.

-

Regulatory and Policy Changes

Payer policies and regulatory requirements change regularly, affecting coverage rules and claim review standards. In fact, claims may fail to meet current criteria when updates are missed or misunderstood. This constant evolution makes compliance difficult, especially for organizations managing multiple payers with differing and frequently revised guidelines.

What Should Providers Need to Do?

Although denial rates are increasing, providers are not without solutions. Healthcare organizations can significantly reduce rejections by implementing proactive strategies and strengthening internal processes. In fact, leveraging technology, improving documentation practices, and enhancing staff expertise enable providers to meet payer expectations while protecting revenue and operational efficiency. Therefore, the providers should implement the following strategies:

-

Adopt AI and Automation Tools

AI-powered claim scrubbing tools can identify errors before submission, reducing the likelihood of rejection. Automation also streamlines repetitive tasks such as eligibility checks and authorization tracking. As a result, providers improve accuracy, streamline workflows, and enable staff to focus on complex billing issues by minimizing manual intervention.

-

Strengthen Clinical Documentation

Clear and detailed clinical documentation plays a key role in claim approval. When provider notes clearly justify medical necessity, payers are more likely to accept claims. Standardized documentation templates help ensure consistency, enabling coders and billers to accurately translate clinical care into compliant claims.

-

Optimize Prior Authorization Workflows

Efficient prior authorization management reduces mismatches between approvals and claims. In fact, centralized systems help track authorization status, validity, and service alignment. Therefore, automating requests and reminders ensures approvals are properly secured, preventing denials due to missing, expired, or improperly documented authorizations.

-

Improve Front-End Revenue Cycle Processes

Strong front-end processes help prevent downstream billing issues. In fact, verifying insurance eligibility, benefits, and coverage limitations before care is delivered ensures claims are built on accurate information. This approach reduces rework, improves first-pass acceptance rates, and minimizes payment delays caused by eligibility-related denials.

-

Invest in Ongoing Staff Training

Regular training ensures billing and coding teams stay current with payer rules, coding updates, and documentation standards. Furthermore, well-trained staff are better equipped to identify errors early and apply guidelines correctly. Continuous education also reduces dependency on individual expertise and improves consistency across teams.

-

Monitor Denial Trends and Root Causes

Tracking denial data provides valuable insight into recurring issues. In fact, the healthcare providers can identify process gaps by analyzing patterns based on payer, service type, or denial reason. As a result, addressing these root causes helps prevent repeat denials, improves compliance, and strengthens long-term financial performance.

Outsourcing Medical Billing and Coding Services in India

Outsourcing revenue cycle and denial management functions to InfoHub Consultancy Services enables providers to access specialized expertise without increasing internal workload. With dedicated teams focused solely on billing accuracy, compliance, and payer-specific requirements, providers can reduce errors caused by staffing limitations. This approach ensures consistent claim quality while allowing internal teams to focus more on patient care.

InfoHub Consultancy Services also integrates advanced analytics, automation tools, and continuous monitoring into the denial-prevention process. In fact, providers can improve first-pass claim acceptance rates by tracking payer behavior, identifying emerging denial trends, and implementing corrective actions early. This proactive support helps stabilize cash flow, reduce rework, and strengthen overall revenue cycle performance.

FAQs

How do claim denials affect provider cash flow?

Claim denials delay reimbursements and increase rework costs, directly impacting cash flow stability.

How long does it typically take to resolve a denied claim?

Resolution timelines vary and can range from weeks to several months, depending on payer processes.

Do denied claims always mean lost revenue?

No, timely appeals and corrections can recover revenue if managed efficiently.

What role does payer communication play in denial reduction?

Clear communication with payers helps clarify requirements and reduces avoidable misunderstandings.

Are smaller practices more vulnerable to claim denials?

Smaller practices may face a higher risk due to limited staffing and fewer automation tools.

Medical Billing

Medical Billing  6 mins read

6 mins read