Why do nearly one in every ten medical claims in the U.S. face denial or delay, and how much revenue is lost correcting avoidable billing errors?

With administrative costs accounting for nearly 15% of total healthcare spending, billing companies are under pressure to deliver speed, accuracy, and compliance. In fact, frequent regulatory changes and growing data security demands further complicate operations. As a result, U.S. billing companies increasingly look beyond cost savings when choosing offshore partners. They seek expertise, quality assurance, and regulatory discipline.

This blog will examine why ICS stands out as a preferred provider of offshore medical billing and coding services in India, highlighting its commitment to training excellence, quality-driven processes, and stringent compliance standards.

Training and Expertise

Certified and Industry-Ready Professionals

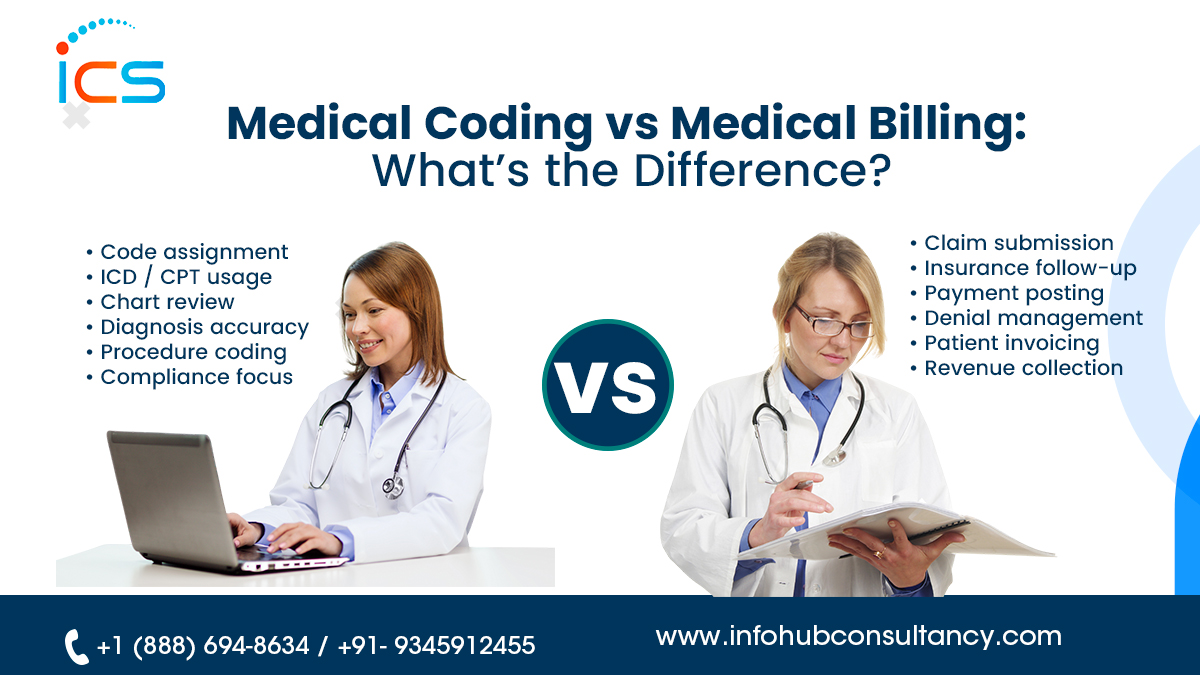

ICS develops its workforce with certified professionals who thoroughly understand U.S. medical billing and coding standards. These certifications ensure accurate use of ICD-10, CPT, and HCPCS codes across workflows. As a result, billing tasks are handled with confidence and precision. This expertise reduces onboarding friction while supporting consistent, compliant outcomes for U.S. billing organizations.

- Structured Onboarding and Role-Based Learning

A structured onboarding framework helps employees understand role-specific responsibilities early. In fact, training is aligned with individual functions such as coding, charge posting, or denial resolution. This clarity improves productivity and reduces reliance on client-side instruction. As processes become familiar, teams perform tasks efficiently and maintain consistency across billing operations and service expectations.

Ongoing Regulatory and Payer Updates

Training programs are designed to reflect frequent changes in U.S. healthcare regulations and payer policies. In fact, updates to CMS rules, documentation standards, and reimbursement guidelines are regularly addressed. This approach ensures workflows remain current without disruption. As a result, staying informed supports billing accuracy and reduces risks associated with outdated practices or incorrect claim submission.

Multi-Specialty and Multi-Payer Exposure

Experience across multiple medical specialties and payer types allows teams to handle varied billing requirements effectively. In fact, exposure to different reimbursement models supports rapid adaptation without the need for repeated retraining. As service needs evolve, workflows remain stable and efficient. This flexibility enables U.S. billing companies to scale operations while maintaining reliable performance levels.

Quality Assurance

Pre-Submission Quality Review

Quality checks conducted before claim submission confirm coding accuracy and alignment of documentation. This proactive review identifies discrepancies early, preventing avoidable payer issues. Also, resolving errors upfront reduces rework and shortens processing timelines. Therefore, accurate submissions improve first-pass acceptance and support smoother revenue flow throughout the billing cycle for U.S. partners.

Focus on Clean Claim Performance

Clean claim submission remains central to billing operations. In fact, careful attention to coding details and documentation completeness reduces rejection rates. As claims move through payers without interruption, reimbursement cycles become more predictable. Therefore, consistent accuracy strengthens cash flow stability while allowing billing teams to focus on higher-value revenue optimization activities.

Routine Internal Audits

Internal audits are conducted routinely to evaluate coding accuracy and process adherence. These reviews help identify patterns and areas requiring improvement. In fact, addressing findings early prevents larger operational issues. Continuous evaluation reinforces accountability and maintains consistent performance standards across teams, ensuring reliable billing outcomes for U.S. healthcare clients.

Denial Trend Evaluation and Correction

Denial data is analyzed to identify recurring issues rather than isolated errors. This structured review helps refine workflows and documentation practices. Corrective actions are implemented to prevent future denials. Thereby, this method leads to reduced rejection rates and improved efficiency across the entire revenue cycle process.

Transparent Performance Reporting

Performance reports provide clear insight into claim status, denials, and financial trends. These metrics help U.S. billing companies monitor performance and identify opportunities for improvement. Furthermore, visibility into outcomes supports informed decision-making. Transparent reporting strengthens trust while maintaining control over billing operations and long-term performance goals.

Compliance and Security

HIPAA-Aligned Operational Practices

Compliance requirements are integrated into daily billing operations through standardized workflows aligned with HIPAA guidelines. Every stage of data handling follows defined privacy protocols. This consistency ensures patient information remains protected throughout the process. As a result, strong compliance integration reduces regulatory exposure while supporting secure offshore collaboration with U.S. billing partners.

Advanced Data Protection Measures

Security controls protect sensitive healthcare data from unauthorized access. In fact, encryption, authentication, and access limitations are applied across systems. These safeguards preserve data integrity and confidentiality. A strong security framework reduces vulnerability to breaches while meeting U.S. healthcare data protection expectations consistently across offshore billing operations.

Secure Infrastructure and Controlled Access

Billing activities operate within secure systems designed for professional healthcare environments. Moreover, access is restricted to authorized personnel using controlled platforms. This prevents data exposure through unsecured networks or informal channels. A secure infrastructure ensures information flows safely and maintains efficiency and compliance throughout billing workflows.

Ongoing Compliance Awareness Training

Employees receive regular training to reinforce privacy responsibilities and security expectations. These sessions promote awareness of proper data handling practices. When teams clearly understand compliance requirements, the risk of human error decreases. As a result, continuous education supports accountability and strengthens a culture focused on protecting sensitive healthcare information.

Audit Readiness and Risk Mitigation

Documentation and compliance records are maintained to support audit readiness. In fact, processes are designed to consistently meet regulatory expectations. This preparation minimizes disruption during reviews and inspections. Proactive risk management helps U.S. billing companies avoid penalties while maintaining operational stability and long-term regulatory confidence.

Conclusion

ICS has emerged as an outsourcing medical billing and coding service provider in India by aligning skilled professionals with structured workflows and strong regulatory awareness. In fact, teams remain consistent with U.S. healthcare requirements and payer expectations through continuous training and standardized processes. As a result, U.S. billing companies gain reliable operational support that maintains accuracy, efficiency, and continuity across billing functions.

Furthermore, ICS delivers long-term value through secure infrastructure, audit-ready documentation, and transparent performance insights. A strong emphasis on data protection and compliance helps reduce regulatory exposure and financial uncertainty. Therefore, these strengths enable U.S. billing organizations to scale operations confidently, maintain revenue integrity, and focus on strategic growth without compromising control or compliance.

FAQs

Can offshore billing services handle fluctuating claim volumes?

Offshore teams are structured to adjust capacity in response to changing claim and workload demands.

How do offshore partners support faster revenue realization?

Dedicated offshore teams help maintain consistent processing speed, reducing delays in claim handling.

How do offshore services support long-term operational growth?

They provide flexibility, consistency, and capacity needed to support expansion without operational strain.

Medical Billing

Medical Billing  6 mins read

6 mins read